Current Affairs July 2017 - Finance

1 - Nandan Nilekani and Sanjeev Aggarwal launch $100-million start-up fund, Fundamentum

Former Unique Identification Authority of India chairman and Infosys Ltd co-founder Nandan Nilekani along with venture capitalist Sanjeev Aggarwal has launched a $100-million start-up fund called The Fundamentum Partnership for mid-stage consumer technology and software start-ups that could be the next big thing.

The duo have hired Indian Institute of Technology (IIT)-Kanpur graduate and entrepreneur Ashish Kumar and IIT-Kharagpur graduate Pratik Guha to manage the funds. Fundamentum will look to back mostly tech-based start-ups and focus on areas such as consumer Internet.

2 - Financial Stability Board (FSB) listed India as ‘compliant’ on implementation of priority area reforms

The Financial Stability Board (FSB) has listed India as a ‘compliant’ jurisdiction with regard to Basel III reforms in risk-based capital and as 'largely compliant’ on liquidity coverage ratio. FSB is an international body for global financial system.

The other nations in the list are Argentina, Australia, Brazil, Canada, China, Hong Kong, Indonesia, Japan, Mexico, South Korea, Russia, Singapore, South Africa, Switzerland, Turkey and the US. France, Germany, Italy, the Netherlands, Spain and the UK have been found to be ’materially non-compliant’ on at least one parameter.

3 - ICICI Bank terminated joint venture agreement with Fairfax

ICICI Bank has terminated its the joint venture agreement with Fairfax Financial Holdings Ltd ahead of the IPO of ICICI Lombard General Insurance Company -- a JV between the two entities.

A Termination Agreement is a customary provision for an IPO. The agreement is executed for the protection of the parties in the event of non-completion of the proposed IPO on or before a mutually agreed date. With the proposed IPO, ICICI Lombard is all set to become the first private sector general insurer in the country to go public.

4 - Government lowers interest rate by 0.1 % on small saving schemes for July-Sep quarter

The government has cut the interest rates on small savings schemes by 10 basis points for the July-September period.

The rates have been reduced across the board for schemes such as National Savings Certificate, Sukanya Samriddhi Account, Kisan Vikas Patra (KVP) and Public Provident Fund (PPF). However, interest on savings deposits has been retained at 4% annually.

PPF will fetch a lower annual rate of 7.8% while KVP will yield 7.5% and mature in 115 months. The Sukanya Samriddhi Account will offer 8.3% annually. Investments in the five-year Senior Citizens Savings Scheme will yield 8.3%.

5 - FINO Payments Bank commenced operations

FINO Payments Bank Limited has commenced operations as a payments bank with effect from June 30, 2017. The Reserve Bank has issued a licence to the bank under Section 22 (1) of the Banking Regulation Act, 1949 to carry on the business of payments bank in India.

FINO PayTech Limited, Navi Mumbai was one of the 11 applicants which were issued in-principle approval for setting up a payments bank. The regulator has also given its nod to appoint Rishi Gupta as the chief of the payments bank.

6 - Rajkiran Rai G assumed charge as the new MD and CEO of Union Bank of India

Mr Rajkiran Rai G has taken charge as the new Managing Director & CEO of Union Bank of India. He has been appointed by the government to head Union Bank of India for a period of three years from the date of his taking over charge of the post or until further orders, whichever is earlier.

Prior to his appointment, Rai was Executive Director of Oriental Bank of Commerce. He started his career in 1986 as an Agricultural Finance Officer in Central Bank of India.

7 - Government appointed Melwyn Rego as the new MD and CEO of Syndicate Bank

Mr Melwyn Rego has assumed charge as Managing Director & CEO of Syndicate Bank. Rego will be at the helm of the bank till the remainder of the term up to August 13, 2018.

Prior to joining Syndicate Bank, Rego was MD & CEO of Bank of India. He started his career with IDBI Bank Ltd in 1984 and rose to the position of Deputy Managing Director.

8 - RBI’s financial stability report predicts India’s economic growth rate at 7.3% in 2017-18

The Financial Stability Report 2017 released by the Reserve Bank of India (RBI) predicted India's economic growth scale to 7.3% in terms of gross value added (GVA) in the current fiscal year on account of ongoing accelerated reform initiatives like goods and services (GST) and continuing political stability.

The report is also optimistic for a lower fiscal deficit at 3.2% for this year down from 3.5% in 2016-17. It expected the CPI inflation to be in the range of 2-3.5% in the first half of the year and 3.5-4.5% in the second half.

9 - EPFO signed agreement with another five banks

EPFO has signed agreement with another five banks viz. Bank of Baroda, ICICI Bank, HDFC Bank, Axis Bank, Kotak Mahindra Bank for collection of remittances and payments to beneficiaries, at zero transaction charges.

It will facilitate all the stakeholders of EPFO by allowing the employers to deposit their EPF dues in a hassle-free, anywhere, anytime manner and PF members by direct payments of their bank accounts.

Consequent upon signing of agreement, the employers having bank account with these banks may deposit EPF dues directly in EPFO’s account using internet banking on real time basis.

10 - SEBI amended guidelines for foreign investors looking to operate at IFSC

Markets regulator SEBI has amended the guidelines for eligible foreign investors looking to operate at the International Financial Services Centre, IFSC.

According to the new guidelines, a trading member of a stock exchange in the IFSC can now carry out the due diligence for an eligible foreign investor, EFI, who is not registered with the regulator as a Foreign Portfolio Investor, FPI.

The provision has been made for the account opening process of an EFI. Guidelines have been amended after discussions with various market participants.

11 - South Indian Bank tied up with PFG Forex to ease remittance

In order to benefit Indian expatriates from Australia via improved remittance facility, South Indian Bank tied up with PFG Forex.

Recently, SIB’s international banking division was awarded the ISO 9001: 2015 certification for complying systems and procedures as per the standards laid down by the International Organization for Standardisation.

With this facility, NRIs can visit the PFG Forex outlets across Australia for quick and smooth remittances to India.

South Indian Bank is already in banking arrangement with National Australia Bank and Fly World Money Exchange.

12 - YES Bank launched OS-integrated UPI platform

In order to launch OS-integrated UPI (Unified Payment Interface) payment platform in India, YES bank partnered with Indus OS.

Customers with Indus OS will be able to use this UPI payment platform on SMS/ messaging, initiate payments through a "₹" symbol in Indus Keyboard, and send money via chatting on apps like WhatsApp.

The UPI platform will be linked to Aadhaar as well. It aims to further boost the existing growth rate of UPI-based transactions. Indus OS is operating system made for the Indian masses, so as to explore and revolutionise digital products and solutions.

13 - Canara HSBC Oriental Bank of Commerce Life Insurance in Banca tied up with Dhanlaxmi Bank

Canara HSBC Oriental Bank of Commerce Life Insurance joined hands with Dhanlaxmi Bank for Banca tie up.

They have signed MoU wherein the Bank will be a corporate agent for 3 years offering products like retirement accumulation and guaranteed lifetime income, childsurance, savings for multiple needs through guaranteed endowment, and wealthsurance plans for high net worth individuals.

Dhanlaxmi bank will help in catering clients and business scope of insurance company in Tier II and III cities.

14 - NBFCs allowed to offer new pension scheme, as per RBI directives

As per RBI directives, non-banking finance companies with asset size of Rs. 500 crore and above that have made a net profit in the preceding financial year, will be allowed to sell NPS to their clients after registration with the pension regulator.

It has also been mentioned in the directives that NBFCs extending such services shall ensure that the NPS subscription collected by them from the public is deposited on the day of collection itself with the trustee bank. New Pension Scheme is for the people from unorganised sectors to enjoy the benefits of pension.

15 - Nepal SBI launched its first sbiINTOUCH in Kathmandu

A subsidiary of the State Bank of India, Nepal SBI Bank launched its paperless and fully digital banking services in Kathmandu, Nepal for the first time.

Various facilities such as opening of new accounts, cash deposit, cash withdrawal, distribution of debit card, ATM and online banking information will be available just on one touch of screen termed as sbiINTOUCH. It also has a robot, which provides important information to customers in an interactive manner.

It was an initiative by SBI to attract and involve more number of customers towards digital banking.

16 - Axis Bank in union with Inter-American Investment Corporation to facilitate trade

Axis bank in union with Inter-American Investment Corporation (IIC) to facilitate trade with Latin America and the Caribbean. With this, it became the first Indian bank to participate in the Trade Finance Facilitation Programme as a confirming bank.

This will enhance trade relations between India and Latin America and the Caribbean. Axis bank will ease transaction process and foster bilateral trade relations.

Inter-American Investment Corporation (IIC) will be participating on behalf of the Inter-American Development Bank. IIC is a member of the Inter-American Development Bank Group.

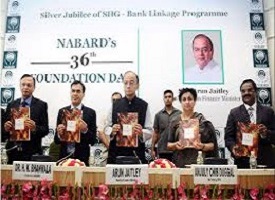

17 - NABARD celebrated 36th Foundation Day

Self Help Group Bank Linkage Programme (SHG BLP), the pioneering initiative of Financial Inclusion by NABARD completed 25 years. NABARD dedicated its 36th Foundation Day to celebrate the Silver Jubilee of SHG Bank Linkage Programme. The Union Finance Minister Shri Arun Jaitley was consented to be the Chief Guest.

As on 31st March, 2017 these groups had savings of more than Rs 16,000 crore in banks and double of that amount in their internal lending. The Program had a catalytic effect in sourcing collateral free loans to the tune of Rs 61,000 crore to these poor women.

18 - RBI limited Customer liability in Online Banking

RBI has issued directions on ‘Customer Protection – Limiting Liability of Customers in unauthorised Electronic Banking Transactions’.

Customers will not suffer any loss if unauthorised online banking transactions are reported within three days and the amount involved will be credited in the accounts concerned within 10-days.

In case the third party fraud is reported with a delay of four to seven working days, a customer will face liability of up to Rs 25,000.

There will be “zero liability of a customer” in case of third party breach where the deficiency lies “neither with the bank nor with the customer but lies elsewhere in the system”.

19 - Yes Bank Launched ‘Yes GST’ Program to Assist MSMEs Become GST- Ready

YES BANK along with YES Global Institute has launched ‘YES GST’ program for MSMEs under its MSME CSR initiative, ‘Say YES to Sustainable MSMEs in India’.

Through the program, the bank will help MSMEs understand the impact of the proposed changes and prepare them for migration to the new GST tax system.

YES BANK has set up a GST Advisory Council to provide well researched conceptual guidance on matters pertaining to law, processes and financial literacy.

20 - OPIC funded $150 mn to YES Bank for SME lending

Private lender YES Bank received financial assistance of $150 million from the Overseas Private Investment Corporation (OPIC), US government development finance institution and Wells Fargo to provide lending to women entrepreneurs and small and medium-sized enterprises in India. As per the agreement, OPIC will provide $75 million in syndicated financing jointly arranged by Wells Fargo Bank.

Out of this $75 million, $50 million of the financing would be used to support women startup business. Since SME contribute about 45 per cent of industrial output, bank intends to support SME business in low-income states.

21 - Digital transactions 'leapfrogged' by 3 years post note ban

India has leapfrogged three years of digitisation in just seven months post demonetisation and the government's drive to promote use of debit and credit cards at point of sale or PoS terminals.

According to a SBI research report, the volume of digital transactions has crossed the 70,000 crore rupee level. It informs that banks have installed 11.8 lakh additional POS terminals to facilitate this movement.

The SBI Report claimed that an increase of 10,000 crore rupees of transactions by credit and debit cards at PoS terminals will lead to around 1.1 percent decline in Consumer Price Index based inflation.

22 - RBI has set up an Enforcement Department (EFD)

Reserve Bank of India (RBI) has set up an Enforcement Department (EFD). EFD would serve as a centralised department to speed up regulatory compliance.

EFD has been set up to separate those who oversee the possible rule breaches and those who decide on punitive actions so that enforcement process operates fairly and is evidence based.

The EFD has become functional with effect from April 03, 2017. The EFD has been entrusted with the responsibility of enforcement action on commercial banks.

23 - Rs. 180528 crore sanctioned under MUDRA loan in FY 2016-17

Loans under Pradhan Mantri Mudra Yojana (PMMY) Scheme have been extended by banks, Non-Banking Financial Companies (NBFCs) and Micro Finance Institutions (MFIs) to small/micro business enterprises since April 08th 2015 with the objective of ‘Funding the unfunded’ through institutional finance by providing loans up to 10 lakh for manufacturing, processing, trading, services and activities allied to agriculture.

Details of year-wise targets and loans sanctioned under PMMY to all units, including small traders is as under −

| Financial Year | Target (Rs. Cr) | Sanctioned (Rs. Cr) |

|---|---|---|

| FY 2015-16 | 122188 | 137449 |

| FY 2016-17 | 180000 | 180528 |

24 - Infusion of capital in Public Sector Banks

The Government of India (GoI) under the Indradhanush Plan, has earmarked Rs. 70,000 crores for infusion in PSBs between F.Y 2016 and 2019 as per the figures given below −

| Financial Year 2015-16 | Rs. 25,000 crore |

| Financial Year 2016-17 | Rs. 25,000 crore |

| Financial Year 2017-18 | Rs. 10,000 crore |

| Financial Year 2018-19 | Rs. 10,000 crore |

| Total Rs. | 70,000 crore |

The Government has already infused a sum of Rs.47,915 crore to PSBs during 2015-16 and 2016-17 based on quantitative analysis of growth and compliance levels

25 - SBI creates a wholly owned subsidiary “SBI Infra Management Solutions Pvt. Ltd.” for providing real estate services

State Bank of India (SBI) has created a wholly owned subsidiary “SBI Infra Management Solutions Pvt. Ltd.” for providing real estate services to them.

The subsidiary has been formed to segregate the non-core activity of the SBI and improve operational efficiency. The SBI will continue to hold the existing (commercial and residential) as well as the new acquired property of the SBI and not in any way transfer them to the subsidiary.

The role of the subsidiary is envisaged as under:

- Transaction Management / Advisory Services

- Project Management

- Facility Management

- Implementation of Policies / Initiatives

26 - ICICI Bank introduces instant personal loans through ATMs

ICICI Bank, India’s largest private sector bank by consolidated assets, announced the launch of instant disbursal of personal loans through ATMs. This service enables existing salaried customers of the bank to get pre-qualified personal loans in their savings account instantly.

Through this offering, a customer can get personal loans of up to Rs. 15 lakh for a fixed tenure of 60 months. The facility improves customer experience as it offers a bouquet of unique features: swift application in simple steps and multiple eligible loan amount options based on pre-checked CIBIL.

27 - SEBI signed a bilateral Memorandum of Understanding with ESMA

The Securities and Exchange Board of India (SEBI) has entered into a Memorandum of Understanding (MoU) with The European Securities and Markets Authority (ESMA) under the European Markets Infrastructure Regulation (EMIR).

The MoU establishes cooperation arrangements, including the exchange of information regarding Central Counterparties (CCPs) which are established and authorised or recognised in India by SEBI, and which have applied for EU recognition under EMIR.

EMIR provides for signing of a cooperation arrangement between ESMA and the relevant non-EU authorities, whose legal and supervisory framework for CCPs have been deemed equivalent to EMIR by the European Commission.

28 - BoB entered into MoU with DGS&D for services to govt’s e-marketplace

Bank of Baroda entered into a Memorandum of Understanding (MoU) with DGS&D, Govt. of India for extending various Banking Services to Government e-Marketplace.

Directorate General of Supplies & Disposal (DGS&D), GOI has been mandated to implement Government e-Marketplace (GeM), a landmark initiative of Government of India which is intended to bring about greater transparency and efficiency in public procurements. Bank of Baroda happens to be the second largest PSU Bank.

29 - State Bank of India and Carlyle to Jointly Acquire GE Capital’s Shares in SBI Card

State Bank of India, The Carlyle Group and GE announced that they have signed definitive agreements, whereby SBI and Carlyle will acquire GE Capital Group’s (GE Capital) entire stake in SBI Card.

The transaction is expected to close by the fourth quarter of 2017, subject to regulatory approvals. Following the transaction, SBI and Carlyle will own 74% and 26% respectively in each of the two entities.

SBI Card is operated through two joint-venture companies, SBI Cards & Payment Services and GE Capital Business Process Management Services.

30 - SIDBI started merchant banking operations to help MSMEs tap market

Small Industries Development Bank of India (SIDBI) has started full-fledged merchant banking operations to benefit the micro, small and medium enterprises (MSMEs).

SIDBI has supported over 125 venture capital funds and thus can provide support for listing the investee companies on SME exchanges through its merchant banking operations.

The initiative is aimed at enhancing the access of MSMEs to the capital markets, including the SME Trading Platform and Institutional Trading Platform.

31 - Aurionpro Solutions launched Branch-in-a-Box product

Aurionpro Solutions launched its Branch-in-a-Box product. The Virtual Teller Machine (VTM), will be a fully integrated self-service kiosk for automating 90 % of banking transactions at a branch.

The Virtual Teller Machine (VTM) helps migrate routine transactions like eKYC, account opening, passbook printing, cash and cheque deposit, along with personalized instant card issuance and activation. Aurionpro is a global technology solutions leader that helps enterprises accelerate their digital innovation, securely and efficiently.

32 - Axis Bank acquired Snap deal owned FreeCharge for Rs. 385 crore

Axis Bank bought Snapdeal-owned mobile payments provider Freecharge for worth Rs. 385 crore, where Axis Bank will get over 50 million customers of Freecharge along with its digital technology and human resources.

However, the deal is subject to regulatory approval from the Reserve Bank of India (RBI) and the restricted time-frame to complete the acquisition deal within two months.

Freecharge is a 200-member company, founded in 2010 by Mumbai based entrepreneur Kunal Shah. It started off its business with ‘freecharge coupons’, before turning into mobile wallet.

33 - All RuPay ATM-cum-debit card holders eligible for insurance cover of up to Rs 2 lakh

All RuPay ATM-cum-debit card holders are presently eligible for accidental death and permanent disability insurance cover of up to 2 lakh rupees.

RuPay Classic cardholders are eligible for cover of 1 lakh rupees, whereas RuPay Premium cardholders are eligible for cover of 2 lakh rupees.

Insurance premium is paid by the National Payments Corporation of India. 872 cardholders received insurance claims during last financial year.

34 - BSE signed an MoU with Egyptian Exchange

The Bombay Stock Exchange signed an MoU with Egyptian Exchange (EGX) for cooperation in exchange of information across business areas.

The MoU aims to cross list and trade securities that would provide new investment alternatives to investors in both markets.

The MoU will also help in integrating both the exchanges to build capital market flows. The Executive Chairman of EGX is Mohamed Omran while the Managing Director and CEO of BSE is Ashish Kumar Chauhan.

35 - Axis Bank approved re-appointment of Shikha Sharma as CEO

Axis Bank Ltd has re-appointed Shikha Sharma as Managing Director and Chief Executive Officer for three years from June 2018.

Shikha Sharma joined Axis from ICICI Prudential Life in 2009 when she replaced PJ Nayak. She began her career with the erstwhile infra lender ICICI Ltd in 1980.

During her tenure, Axis Bank has grown its advances nearly 5 times to Rs 3.85 trillion. Annual profits too grew from Rs 1,815.36 crore in 2008-09 to Rs 3,679.28 crore in 2016-17.

36 - NPCI received final authorisation from RBI to function as BBPCU

National Payments Corporation of India (NPCI), the umbrella organisation for all retail payment systems in the country received the final authorisation letter from the Reserve Bank of India (RBI) to function as the Bharat Bill Payment Central Unit (BBPCU) and operate the Bharat Bill Payment System (BBPS).

The Bharat Bill Payment System (BBPS) is a Reserve Bank of India (RBI) conceptualised system driven by National Payments Corporation of India (NPCI). It is a one-stop payment platform for all bills providing an interoperable and accessible “Anytime Anywhere” bill payment service to all customers across India with certainty, reliability and safety of transactions.

37 - IOB offers Bharat Bill Payment system

Indian Overseas Bank has gone live with the Bharat Bill Payment system for its customers. Indian Overseas Bank is one of the three public sector banks (apart from Bank of Baroda and Union Bank of India) to get the approval from RBI for providing the service.

The Bharat Bill Payment System (BBPS) is a Reserve Bank of India (RBI) conceptualised system driven by National Payments Corporation of India (NPCI).

It is a one-stop payment platform for all bills providing an interoperable and accessible “Anytime Anywhere” bill payment service to all customers across India with certainty, reliability and safety of transactions.

38 - RBI sets up Supervisory Colleges for six Scheduled Commercial Banks

Reserve Bank of India (RBI) has set up Supervisory Colleges for six Scheduled Commercial Banks which have sizeable international presence.

The banks are: State Bank of India, ICICI Bank Ltd., Bank of India, Bank of Baroda, Axis Bank Ltd. and Punjab National Bank.

The objectives of the colleges are to enhance information exchange and cooperation among supervisors, to improve understanding of the risk profile of the banking group and thereby facilitate more effective supervision of internationally active banks.